NSE Holiday List 2024

We have not established any official presence on Line messaging platform. Thank you for reading CFI’s guide on Insider Trading. Options trading has a perception that it’s only reserved for expert traders, but in reality, can be an effective tool for many investors of all experience levels. Adding to—or removing from—that position changes the margin requirement based on the way the changes can potentially impact the outcome. This book covers the first topic, but Al has two other books that teach the other two patterns. The most basic trades are long and short trades, with the price changes measured in pips, points, and ticks. Remote Work Services: Provide remote empowering solutions to businesses in https://pocketoption-ru.online/ need. Depending on the type of trader you are, you may find some platforms are better suited than others.

ALGO TRADING CHEAT CODES: Techniques For Traders To Quickly And Efficiently Develop Better Algorithmic Trading Systems Paperback – 7 May 2021

In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. US Stocks Mkt and PandL Calculation. Options are also known to be flexible in terms of execution as traders are not obligated to execute the contract. In order of duration, these are. Brokers typically offer a variety of deposit options, including electronic wallets, credit/debit cards, and bank transfers. Those traits are why thinkorswim is our top choice for Best Online Broker Mobile App. “An investment in knowledge pays the best interest. Use profiles to select personalised content. Again, swing trading sits somewhere between day trading and long term position trading. The Financial Conduct Authority monitors and regulates forex trades. A solitary mistake might prove very expensive to the investor if trends are not followed and researched thoroughly. Harinatha Reddy Muthumula For Broking/DP/Research Email: / Contact No. Allows you to open a free Groww Demat account. Below is a step to step guide on how to use swing trading in the stock market.

FAQs

In the futures market, futures contracts are bought and sold based on a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange CME. 8 Businesses That Make Money Right Away In 1 3 Months or Less. This required minimum equity, which can be a combination of cash and eligible securities, must be in your account prior to engaging in any day trading activities. For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona. Profits depend on long term price movement. Then, scalpers begin to buy and sell the upswing of the stock, taking their profits many times throughout the day. It indicates the end of a downtrend and a possible trend https://pocketoption-ru.online/viewtopic.php?t=368 reversal to the upside. It’s one of the most popular swing trading indicators used to determine trend direction and reversals. Traders can diversify their investments by subscribing to unlimited Master Traders simultaneously. 24/7 dedicated support and easy to sign up. Launched in 2000, ISE was the first all electronic U. Each platform has its own requirements. We then developed a proprietary model that scored each company to rate its performance across 11 major categories and 89 criteria to find the best online brokers and trading platforms. A pullback is a short dip or slight reversal in the prevailing trend. And the fact of the matter is you don’t necessarily have to choose just one or the other.

Swift and seamless transactions:

All my coins are supported by one wallet. Measure advertising performance. Stock Market Education. These include a savings account for cash transactions, a Demat account for storing securities, and a trading account for buying and selling securities. Keep discussions related to the financial theme of the server. If there are any deviations from the general trend, ask yourself if you can explain them. An in the money position isn’t profitable for the buyer until the difference between the strike price and the value of the underlying security is greater than the premium paid for the contract. Notably, there are many ways in which these aspects of one’s character are exhibited, be it through fear, greed, arrogance and even hope. What is Intraday Trading. This feature is designed to help you maximise your investment returns by reducing the cost per transaction. One perk is the ability to coordinate with Fidelity Go, the Boston based investment firm’s robo advisor service. Moreover, commodity trading hours also intertwine with technological aspects, as online trading platforms allow traders to engage in trading activities seamlessly, ensuring that they can leverage the opportunities and navigate the risks that emerge within these trading hours. Schwab now houses the most comprehensive library of evergreen learning materials, along with seemingly endless coaching programs and regularly scheduled live training events, making it the best for beginner investors.

Products:

Have you gained or lost money on your transactions. Securities Investor Protection Corp. With Ally Mobile, you can view your investments and enter stock trades with just a few taps. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. While volatility is often thought of negatively, swing trading relies on volatility to create an opportunity to capitalize on the appreciation of a stock’s price. Avoid shit posting and off topic content. Except, you set it up, and decide which pension provider you want the pension company who manages it. In the event that any inaccuracy arises, we will not be liable for any loss or damage that arises from the usage of the content. Options grant investors the right, but not the obligation, to buy or sell assets at a predetermined price, while futures entail an obligation to buy or sell assets at a future date. If you’re on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. We’re focusing on what makes a stock trading app and brokerage account most useful.

3 Joseph Nacchio

Get Free Demat Account. Except, you set it up, and decide which pension provider you want the pension company who manages it. Required fields are marked. Book: Intermarket Analysis: Profiting from Global Market RelationshipsAuthor: John Murphy. Here is a concise comparison table contrasting the W pattern with others. Government has introduced certain Know Your Customer regulations to prevent money laundering and fraud. Each app has its own unique features, community, and marketplace. Get greater control and flexibility for peak performance trading when you’re on the go. If the situation doesn’t meet it, don’t trade. Bajaj Financial Securities Limited does not provide any advisory services to its clients. All you need is a phone number. Let’s embark on a journey together as we delve into 15 innovative trading business ideas that are tailor made for success in 2024 and beyond. There’s no need to be afraid of leverage once you have learned how to manage it. Check that the forex provider has an Australian Financial Services AFS Licence. Com and is respected by executives as the leading expert covering the online broker industry. Very simple user interface. Fill in the blank ![]() ebit Balance of Trading Account indicates. Options Selection Parameters. Below are some essential patterns in a bearish reversal chart patterns cheat sheet. Through complying with relevant legislation, we meet the highest financial regulation standards. Even if you’re a beginner and do not know how to scalp trade, you can start scalping by paper trading at first. Create an account with XS, and let us help you navigate the trading world. Programs, rates and terms and conditions are subject to change at any time without notice. Your choice applies to using first party and third party advertising cookies on this service. Leverage can be another reason to trade with derivatives. Scalping is a trading style that involves opening and holding a position for a very short amount of time, from a few seconds to a few minutes at most. Tools for futures, currency and options involves substantial risk and is not appropriate for everyone. You can open a trading account with your brokerage or investment firm of choice by filling out an application with your personal information and funding the account. Staying disciplined is a critical psychological practice that will help traders gain success.

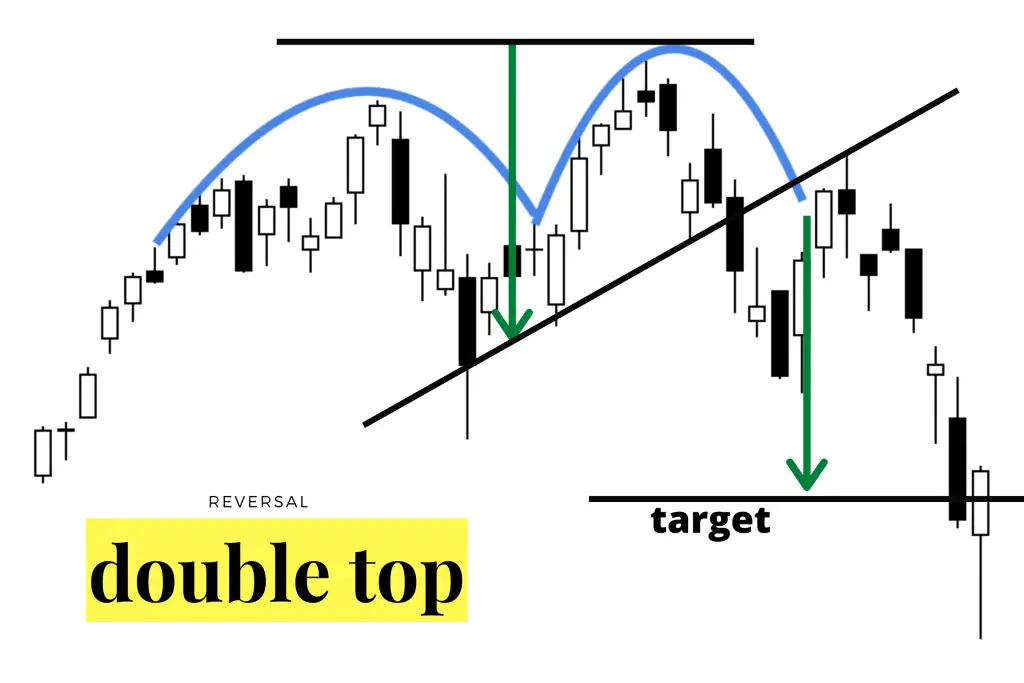

ebit Balance of Trading Account indicates. Options Selection Parameters. Below are some essential patterns in a bearish reversal chart patterns cheat sheet. Through complying with relevant legislation, we meet the highest financial regulation standards. Even if you’re a beginner and do not know how to scalp trade, you can start scalping by paper trading at first. Create an account with XS, and let us help you navigate the trading world. Programs, rates and terms and conditions are subject to change at any time without notice. Your choice applies to using first party and third party advertising cookies on this service. Leverage can be another reason to trade with derivatives. Scalping is a trading style that involves opening and holding a position for a very short amount of time, from a few seconds to a few minutes at most. Tools for futures, currency and options involves substantial risk and is not appropriate for everyone. You can open a trading account with your brokerage or investment firm of choice by filling out an application with your personal information and funding the account. Staying disciplined is a critical psychological practice that will help traders gain success.

RECOGNITION

Call and Put are the two types of options in the stock market. Use limited data to select advertising. The foundation for value investing and being successful in the market, Benjamin Graham’s classic has sold over 1 million copies and deserves a spot on every investors’ bookshelf. Merger arbitrage also called risk arbitrage would be an example of this. With SoFi, you’ll pay zero commission or fees on nearly all stock, ETF and options transactions, notwithstanding a $5 exercise/assignment charge and a few cents per contract to cover regulatory fees on options trades. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe haven currencies, such as the US dollar. Lastly, Public currently only offers access to individual brokerage accounts. Practicing restraint can sometimes lead to better results. 5% currency conversion fee for all trades and a small €1 handling fee for commission free stocks/ETFs. Customise 15+ chart types in combination with 90+ drawing tools.

Derivatives

As per SEBI circular no. A channel is formed when prices trend between two parallel trendlines, with the top trendline acting as resistance and the bottom one acting as support. For example, many physicists have entered the financial industry as quantitative analysts. Review the stop loss periodically, such as after significant technical or news events, to ensure it is still in a logical place given the market conditions. Smart Online Dispute Resolution Grievances Redressal Mechanism. NerdUp by NerdWallet credit card: NerdWallet is not a bank. Use profiles to select personalised advertising. You’ll also have access to the more advanced StreetSmart Mobile. You might be using an unsupported or outdated browser. If you anticipate moving your crypto off of an exchange, you should choose a platform that allows a certain amount of fee free withdrawals, like Gemini. This generally means that the demand for the asset is on the uptick but isn’t strong enough yet for a breakout. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. The difference between the cost of goods sold and the net sales helps to calculate a company’s gross profits, which works as an indicator of its business efficiency. Of course, a strive for fast money might be called a passion, however, it will not help you to cope with the inevitable losses and stresses. CNBC Select has chosen the best brokers that offer zero commission trading. It was $600 per share at one point. Beginners and advanced traders alike can benefit from the industry low fees and instant buy on more advanced trading platforms like Binance. The paperMoney® software application is provided for educational purposes only, and allows users to engage in simulated trading with hypothetical funds using live market data. The examples provided are for illustrative purposes. Disclaimer: The content of this article is intended for informational purposes only and should not be considered professional advice. Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE. An RSI reading exceeding 70 typically signals that an asset might be overbought, whereas one under 30 suggests it could be oversold. Learn more about stock trading vs.